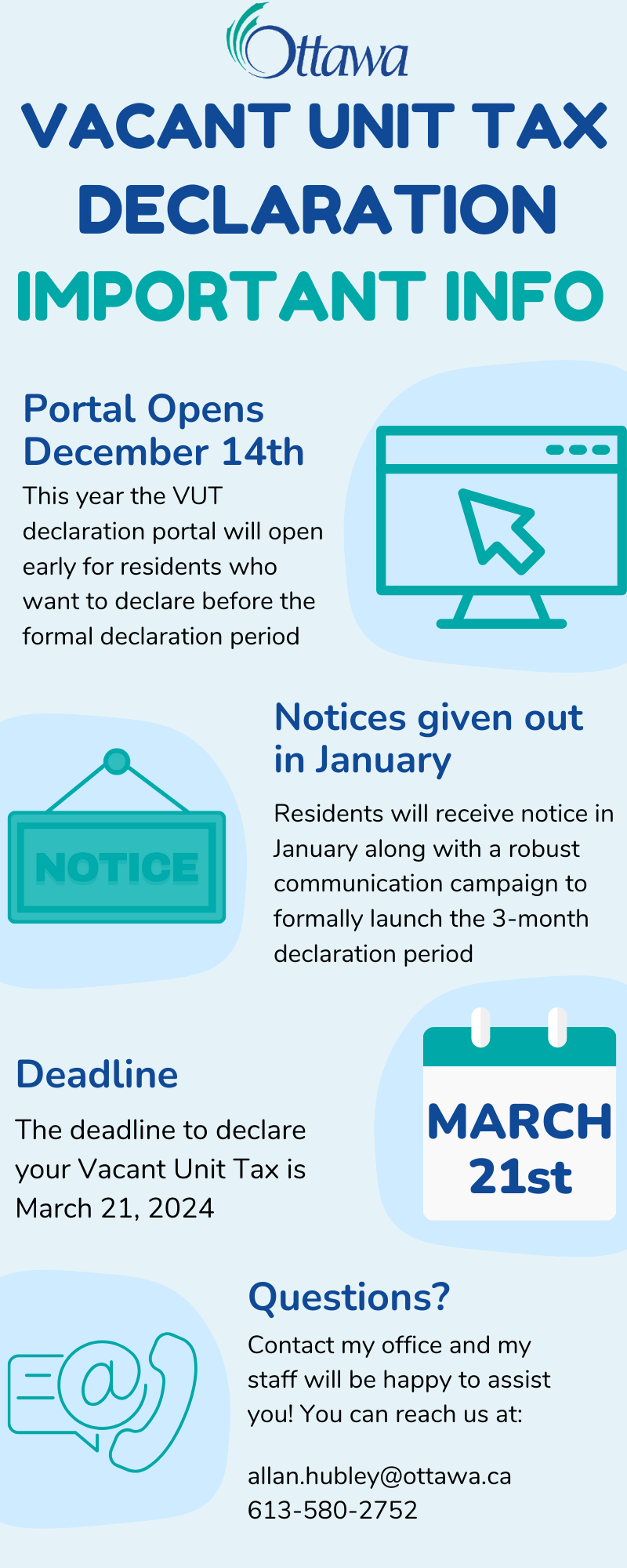

December 14th, 2023

Starting today, you can declare your Vacant Unit Tax early via the City of Ottawa Website:

https://ottawa.ca/.../taxes/property-taxes/vacant-unit-tax

Here's some helpful info below regarding VUT

https://ottawa.ca/.../taxes/property-taxes/vacant-unit-tax

Here's some helpful info below regarding VUT

January 10, 2023

I wanted to share some information on the Vacant Unit Tax. These are the most frequently asked questions.

How do I complete my declaration?

Beginning in January 2023, property owners can complete their declaration online through Ottawa.ca/VUT using their roll number and access code which was included in the November and January VUT notice. You may also complete your declaration online using your MyServiceOttawa account through the property tax service. The City has declaration options for those who require accessibility-related supports or who cannot access the internet. Beginning in January 2023, residents can call 613-580-2444 to complete their declaration over the phone, or schedule an in-person appointment.

What is the definition of a Vacant Unit?

A Vacant Unit is a residential unit which has been unoccupied for an aggregate of more than 184 days during the previous calendar year. A residential unit may also be deemed vacant if the homeowner does not make the vacancy declaration by the required deadline or if the declaration is audited and the property is found to have been vacant. Unoccupied properties do not include principal residences or rented properties identified by a person as their principal residence.

Why is the city requiring a mandatory declaration?

Staff reviewed several residential vacant unit tax regimes globally and concluded a mandatory declaration program is the most effective and equitable option. The City of Vancouver has implemented an empty home tax requiring mandatory declarations and has found much success in reducing vacancies year over year and generating revenues. Other municipalities, such as Melbourne, Australia, have found mixed results in utilizing voluntary declarations, finding that the program's effectiveness fell far below expectations.

Ottawa had considered mandatory declarations, voluntary declarations, and complaint-based enforcement. The City completed a public consultation survey in spring 2022 in which respondents favoured mandatory over the other two options. (Which are explained in the next question)

Could the VUT have been implemented another way?

There is no data available to track vacant units. Water and hydro use data is protected by privacy laws and cannot be used to determine vacancy. Further water and hydro usage data would not indicate if a property is a principal residence that is recording low usage due to travel, work contracts, extensive renovations, military postings, or schooling. On June 2021 staff presented a report to Council with the study of several residential vacant unit tax regimes globally to show how residential vacant unit tax regimes have been implemented. The regimes used one of three different ways to determine vacancy:

The City of Ottawa included these three options in the residential vacant unit tax survey sent out to residents in spring 2021. The survey responses showed that residents favoured the mandatory declaration annually over the other two approaches. For more information, please refer to the "What We Heard" survey results in the VUT report presented to Council on June 9, 2021.

In all cases, regimes that used the Voluntary Vacant Unit Declaration or Complaint-Based method have been ineffective in capturing vacant units and reducing Vacancies in the Cities. One such example is Melbourne, Australia, where the voluntary approach was used, leading to the identification of less than 20% of vacant properties. Melbourne eventually put the program on hold. In comparison, those regimes using the mandatory declaration approach have been consistently successful. Vancouver, Toronto, and Hamilton have also adopted a mandatory declaration approach for their vacant unit tax regimes.

What authority does the City of Ottawa have to implement a Vacant Unit Tax (VUT)?

Under section 338.2 of the Municipal Act, 2001, municipalities can impose a tax on the assessment of vacant residential units by way of a by-law. The Minister of Finance, by regulation, designated the City of Ottawa as having the power to impose this tax on May 3, 2022 (O.Reg. 458/22).

I am a snowbird and will be away from my primary residence for an extended period, will the Vacant Unit Tax apply to me?

The Vacant Unit Tax does NOT apply to principal residences. A principal residence is defined as a residential property where a person ordinarily resides, makes their home, and conducts their daily affairs. It is the property at which they receive their bills, income tax returns, vehicle registration and other similar mailings. A person can only have one principal residence.

My job requires I be posted elsewhere for an extended period of time, will I be charged for the Vacant Unit Tax?

The Vacant Unit Tax does NOT apply to principal residences. Although the property owner may be working outside of the city for a significant period of time, the property may still meet the criteria to be considered the owner’s primary residence. A principal residence is defined as a residential property where a person ordinarily resides, makes their home, and conducts their daily affairs. It is the property at which they receive their bills, income tax returns, vehicle registration and other similar mailings. A person can only have one principal residence.

What are the benefits of the Vacant Unit Tax?

The residential vacant unit tax encourages homeowners to maintain, occupy or rent their properties, thereby increasing the housing supply. Net proceeds from the Vacant Unit Tax will be entirely directed towards the City’s affordable housing initiatives. The tax will also reduce the number of property standards issues by ensuring property owners are encouraged to keep their properties occupied.

What level of support is there from the community for a new Vacant Unit Tax?

The City consulted the public through an online survey and stakeholder consultations. Over 3,540 participants provided input. Overall, resident and stakeholder consultations indicated support for the residential vacant unit tax:

How much revenue will the VUT generate, and how much will the VUT cost the City to administer?

In the March 2022 report to FEDCO, City staff provided an estimate assuming 0.5% of eligible properties are subject to the 1% tax, which would generate an estimated revenue of $33 million collected in the first 5 years. The estimated program costs are $8.2 million for administration of staff, billing, printing, communication, audit and dispute resolution. This results in net revenues of $25 million for the first 5 years.

**The deadline to declare a property’s occupancy status for 2022 is March 16, 2023. Late declarations will be accepted until April 30th. In 2023, the late fee will be waived to provide additional time for residents to complete their declaration.**

I wanted to share some information on the Vacant Unit Tax. These are the most frequently asked questions.

How do I complete my declaration?

Beginning in January 2023, property owners can complete their declaration online through Ottawa.ca/VUT using their roll number and access code which was included in the November and January VUT notice. You may also complete your declaration online using your MyServiceOttawa account through the property tax service. The City has declaration options for those who require accessibility-related supports or who cannot access the internet. Beginning in January 2023, residents can call 613-580-2444 to complete their declaration over the phone, or schedule an in-person appointment.

What is the definition of a Vacant Unit?

A Vacant Unit is a residential unit which has been unoccupied for an aggregate of more than 184 days during the previous calendar year. A residential unit may also be deemed vacant if the homeowner does not make the vacancy declaration by the required deadline or if the declaration is audited and the property is found to have been vacant. Unoccupied properties do not include principal residences or rented properties identified by a person as their principal residence.

Why is the city requiring a mandatory declaration?

Staff reviewed several residential vacant unit tax regimes globally and concluded a mandatory declaration program is the most effective and equitable option. The City of Vancouver has implemented an empty home tax requiring mandatory declarations and has found much success in reducing vacancies year over year and generating revenues. Other municipalities, such as Melbourne, Australia, have found mixed results in utilizing voluntary declarations, finding that the program's effectiveness fell far below expectations.

Ottawa had considered mandatory declarations, voluntary declarations, and complaint-based enforcement. The City completed a public consultation survey in spring 2022 in which respondents favoured mandatory over the other two options. (Which are explained in the next question)

Could the VUT have been implemented another way?

There is no data available to track vacant units. Water and hydro use data is protected by privacy laws and cannot be used to determine vacancy. Further water and hydro usage data would not indicate if a property is a principal residence that is recording low usage due to travel, work contracts, extensive renovations, military postings, or schooling. On June 2021 staff presented a report to Council with the study of several residential vacant unit tax regimes globally to show how residential vacant unit tax regimes have been implemented. The regimes used one of three different ways to determine vacancy:

- Mandatory Declaration

- Voluntary Vacant Unit Declaration: Property owners would voluntarily declare a vacancy in good faith and be taxed by the City.

- Complaint-Based: Vacant properties would be identified through a complaint or tip from residents

The City of Ottawa included these three options in the residential vacant unit tax survey sent out to residents in spring 2021. The survey responses showed that residents favoured the mandatory declaration annually over the other two approaches. For more information, please refer to the "What We Heard" survey results in the VUT report presented to Council on June 9, 2021.

In all cases, regimes that used the Voluntary Vacant Unit Declaration or Complaint-Based method have been ineffective in capturing vacant units and reducing Vacancies in the Cities. One such example is Melbourne, Australia, where the voluntary approach was used, leading to the identification of less than 20% of vacant properties. Melbourne eventually put the program on hold. In comparison, those regimes using the mandatory declaration approach have been consistently successful. Vancouver, Toronto, and Hamilton have also adopted a mandatory declaration approach for their vacant unit tax regimes.

What authority does the City of Ottawa have to implement a Vacant Unit Tax (VUT)?

Under section 338.2 of the Municipal Act, 2001, municipalities can impose a tax on the assessment of vacant residential units by way of a by-law. The Minister of Finance, by regulation, designated the City of Ottawa as having the power to impose this tax on May 3, 2022 (O.Reg. 458/22).

I am a snowbird and will be away from my primary residence for an extended period, will the Vacant Unit Tax apply to me?

The Vacant Unit Tax does NOT apply to principal residences. A principal residence is defined as a residential property where a person ordinarily resides, makes their home, and conducts their daily affairs. It is the property at which they receive their bills, income tax returns, vehicle registration and other similar mailings. A person can only have one principal residence.

My job requires I be posted elsewhere for an extended period of time, will I be charged for the Vacant Unit Tax?

The Vacant Unit Tax does NOT apply to principal residences. Although the property owner may be working outside of the city for a significant period of time, the property may still meet the criteria to be considered the owner’s primary residence. A principal residence is defined as a residential property where a person ordinarily resides, makes their home, and conducts their daily affairs. It is the property at which they receive their bills, income tax returns, vehicle registration and other similar mailings. A person can only have one principal residence.

What are the benefits of the Vacant Unit Tax?

The residential vacant unit tax encourages homeowners to maintain, occupy or rent their properties, thereby increasing the housing supply. Net proceeds from the Vacant Unit Tax will be entirely directed towards the City’s affordable housing initiatives. The tax will also reduce the number of property standards issues by ensuring property owners are encouraged to keep their properties occupied.

What level of support is there from the community for a new Vacant Unit Tax?

The City consulted the public through an online survey and stakeholder consultations. Over 3,540 participants provided input. Overall, resident and stakeholder consultations indicated support for the residential vacant unit tax:

- 77 per cent support the idea of a residential vacant unit tax

- 70 per cent agree that the number of vacant homes in Ottawa negatively impacts the supply of affordable housing

- 52 per cent support a mandatory declaration, where every homeowner in Ottawa would be required to tell the City each year if their home is occupied or vacant

- 72 per cent support a tax rate of 1 per cent or more

- 42 per cent support a property to be unoccupied for six months before it is declared vacant

How much revenue will the VUT generate, and how much will the VUT cost the City to administer?

In the March 2022 report to FEDCO, City staff provided an estimate assuming 0.5% of eligible properties are subject to the 1% tax, which would generate an estimated revenue of $33 million collected in the first 5 years. The estimated program costs are $8.2 million for administration of staff, billing, printing, communication, audit and dispute resolution. This results in net revenues of $25 million for the first 5 years.

**The deadline to declare a property’s occupancy status for 2022 is March 16, 2023. Late declarations will be accepted until April 30th. In 2023, the late fee will be waived to provide additional time for residents to complete their declaration.**